Living abroad health insurance is a great option for expatriates or anyone visiting a foreign land. It can give you peace of mind, and help protect your finances. The insurance is ideal for those who have frequent travels and long stays, as well as for families.

The process of choosing an international medical insurance policy can be complex, so it is important to understand the details prior to making a purchase. A policy from a reputable provider can give you peace of mind when traveling abroad.

A basic overview of expat/expat insurance

Many people find living abroad an exciting adventure, but it also comes with challenges. It may be necessary to learn another language or to adapt to a completely different culture. You may also need to find out how to use public healthcare or pay for private treatment in a hospital.

In order to ensure that you are covered for any medical emergencies abroad or at home, it is best to purchase an international insurance policy. Typically, these policies are available in several formats and can be tailored to suit your specific needs.

How to purchase an expatriate insurance policy

Expat insurance plans tend to be more comprehensive than travel plans and include benefits like accident, critical illnesses, dental, vision care, and others. International health insurance plans may also include emergency evacuation and care as part of the benefits.

US Citizen Health Insurance Overseas

As a United States citizen, you may be eligible for Obamacare-compliant medical insurance when traveling outside the U.S. You can however take advantage of exemptions.

IRS "Physical Presence Test". This test is applicable to US Citizens who spend 330 or longer days in a foreign nation per year. The Bona Fide Residence Test is another exemption available to US citizens.

As soon as you become a US Citizen and move to another country, consider getting international medical coverage. You can avoid any problems with immigration when you apply for your visa, and also save money on medical expenses.

Contacting an international health insurance specialist is the best way to find a policy. It can be an advisor you trust who can determine your needs and then recommend a plan that meets them.

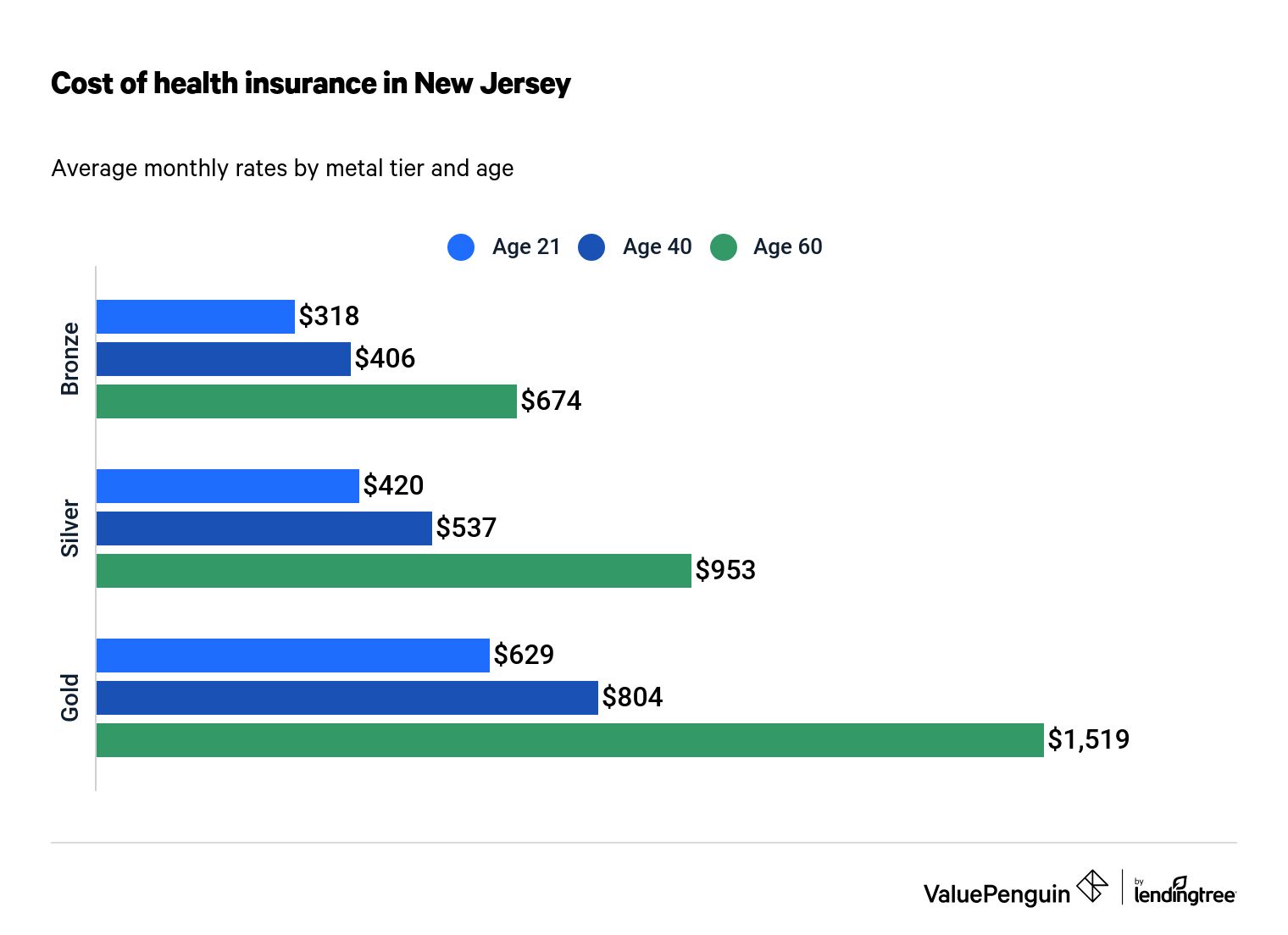

Compare the costs of different expat health insurance policies. Take into consideration your age and your current health. This will allow you to select the right policy for yourself and your family.

How to Purchase an Expatriate Medical Insurance Plan

You can buy international health insurance online, by phone, or in person. You can get quotes from local insurance companies or speak to an international health insurance expert.