Kin is a direct to consumer home insurer founded in 2016. It offers affordable rates for homeowners in coastal areas that are prone towards catastrophic events. The policies are easy to use and understand, and provide accurate pricing and high-quality claim service.

Consumer Reports named Kin in 2018 as the top online home insurance provider. It is a company with a strong culture that puts the customer first. They offer high-value discounts, and claim to pay dividends if policyholders have a low loss.

Getting the right home insurance can help you save money and protect your investment in case of theft, fire or other types of damage. It can be confusing to decide which insurance coverage is best for you.

It is possible to read reviews written by other customers about what they liked or disliked regarding their experience with an insurer. You can then make an informed choice about switching to a different policy.

Some kin home insurance reviews talk about the quality of the company's customer service, while others say that they had an unsatisfactory experience. You should be aware that some reviews could be biased as they are written by people with a personal relationship to the insurer.

One of the biggest complaints about kin is that it does not offer auto insurance or bundling options. These can be beneficial for customers who have multiple policies with a single company, as they can bundle policies together and get additional discounts.

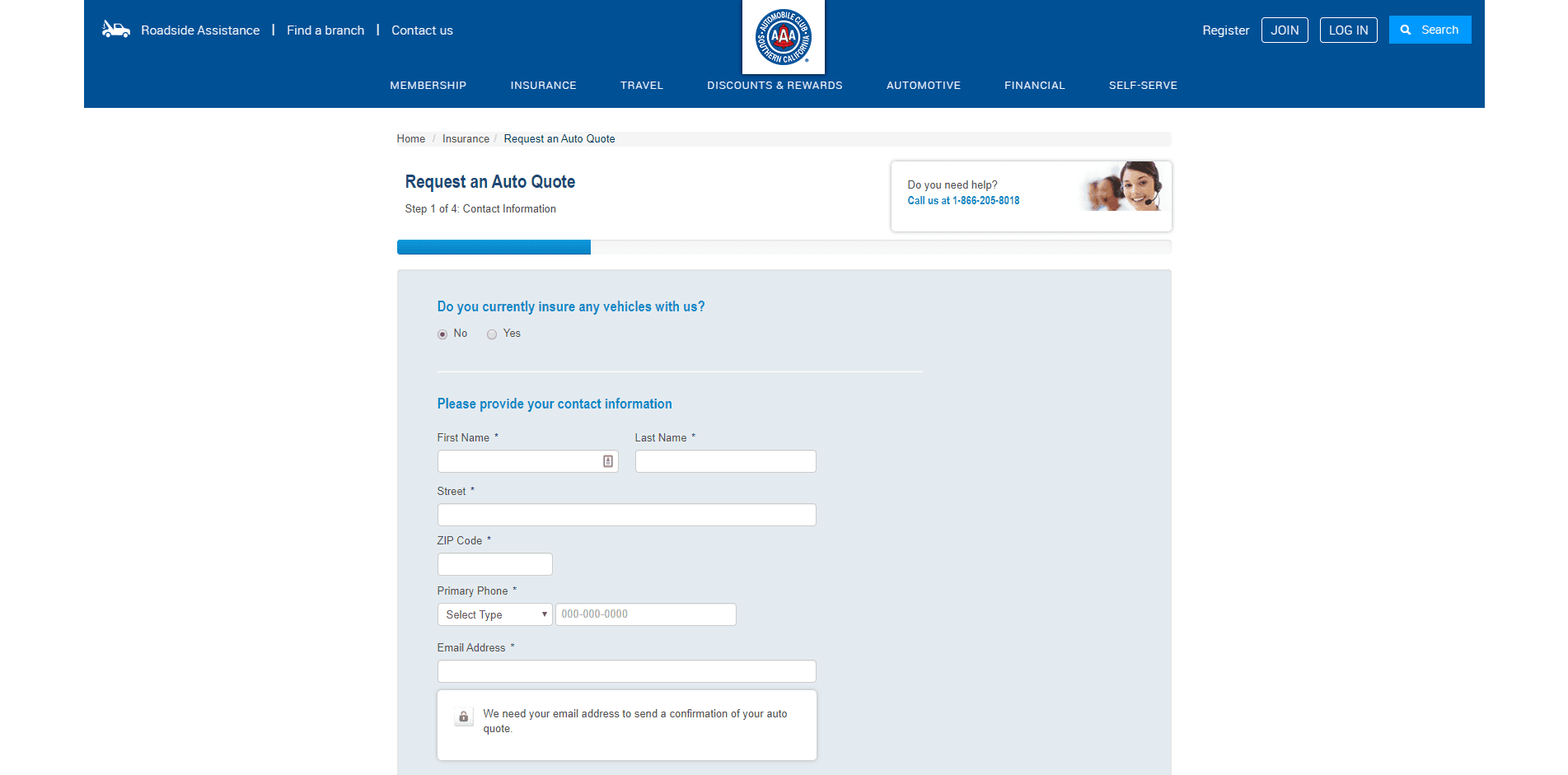

Also, the website is not always easy to navigate. You may also have to wait for a bit before you are able to complete the online application.

The terms and conditions for kin can also be confusing. It is important to note that you will have to pay an initial deductible if you want your claim for damage to be accepted. This can be confusing. If you're not sure if the deductible is required, ask your broker or agent.

This is an excellent choice for Florida and Louisiana residents. However, it isn't available yet in other states. The good news is that it's very easy to locate a company in these states. But there are some limitations.

Kin uses a unique method to monitor homes in hurricane-prone regions, which helps prevent the spread of damage. This allows the company to save money by reducing the number of insurance claims.

The company also has a unique way of filing claims. Kin will inspect your house instead of waiting for disasters to strike. The team can then pinpoint the exact location of damage to your home and alert you.

This is a very valuable tool for any homeowner that has been through an extreme weather event. It allows them to make a claim, and get paid the quickest. You can avoid expensive repairs by replacing your damaged items with new ones.