Home insurance is important if you plan to purchase or consider a mobile home. You'll want a policy that includes specialized coverage for the type of structure you're buying and the personal belongings you own.

Allstate Manufactured Home Insurance Review

Allstate Mobile Home Insurance is available in 19 States. Customers can choose from a variety of unique endorsements including matching siding, additional living costs during the rebuilding phase and more. Optionally, you can purchase replacement cost coverage for items that have been damaged or are lost.

A typical policy for home insurance will cover the manufactured home you own and any personal property in it against damage caused to them by covered perils, such as a storm or fire. You can get endorsements to cover things not covered in a standard policy. For example, liability protection.

GEICO Mobile Home Insurance Reviews

You can choose from two types of manufactured home policies from GEICO: replacement value and actual cash value. Replacement value policies cost more than an ACV, but offer better protection against financial loss.

Depending on your state, you can also purchase an extended replacement value policy that pays the full amount of your home's insurance premium to repair or replace your home after a covered loss. The policy premium is determined by the replacement cost of your home. This is generally higher than your depreciated property value.

Foremost offers a wide network of agents, and competitive rates for both new and used manufactured homes. Compare quotes by phone or on the internet, but be prepared to wait a couple of days to get a quote.

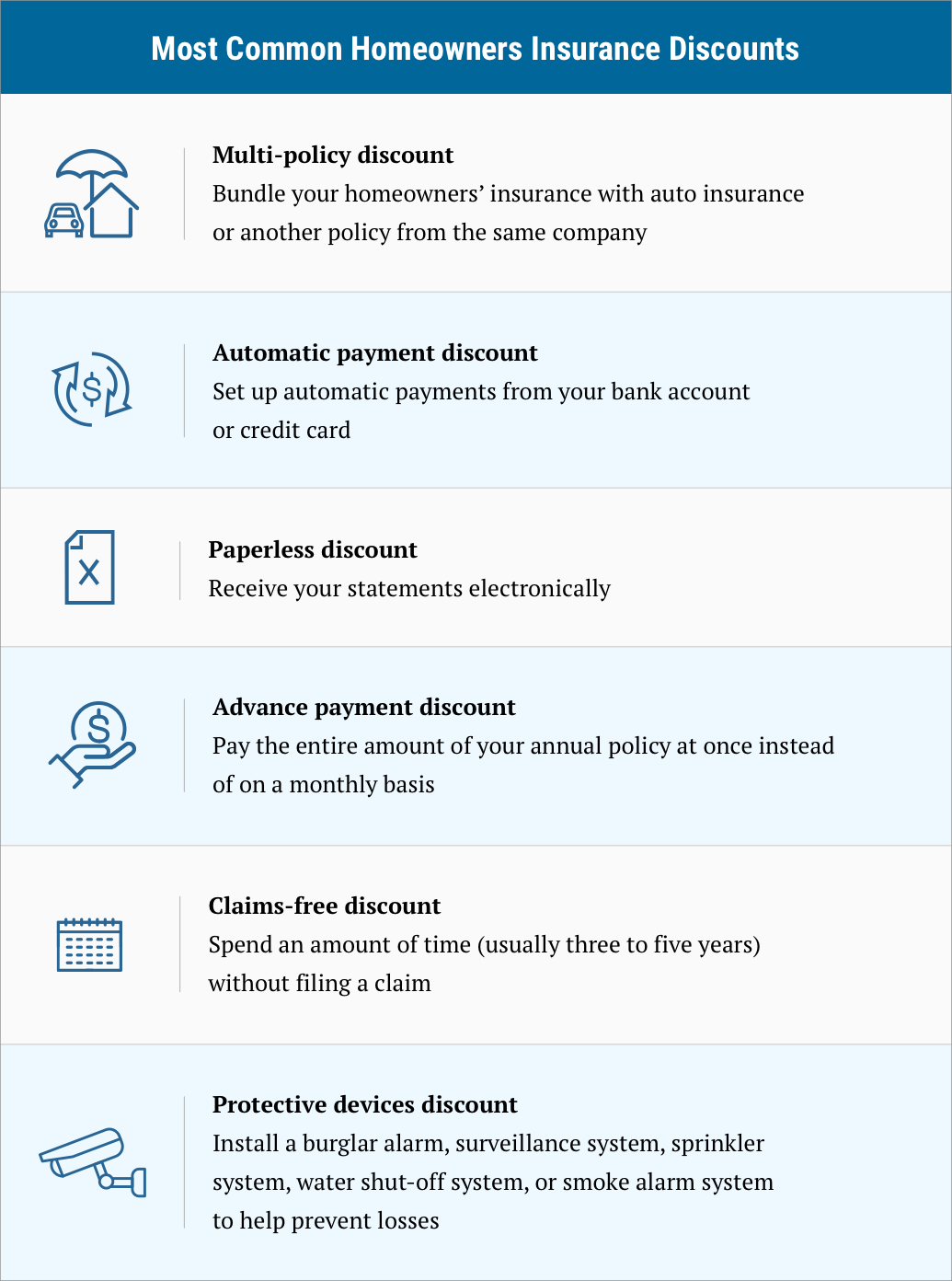

Many insurers offer discounts for things like smoke detectors, storm shutters and having a garage or shed on your property. If you choose a no-deductible policy or a low-deductible plan, you can save.

Asking an agent to do the shopping for you is the best way to get a policy that suits your needs. Some companies offer exclusive discounts for mobile homes that are not available to other homeowners. Others may be more willing than others to work with customers who want to save money on their insurance.

Progressive offers mobile home insurance with a number of options. These include replacement cost, additional living expenses and more. It also offers various endorsements that include coverage for hobby agriculture and livestock.

Farmers' mobile home insurance has many supplemental options. This includes an agreed loss settlement. It has the option of adding replacement costs coverage which will pay for your home to be replaced with brand new products instead of its depreciated cost.

It is important to protect your mobile home as it is a valuable investment. That is why mobile home communities and mortgage lenders often require that you purchase a homeowners insurance policy. The manufactured home is the perfect choice for those who don't want to spend time building their home.