Do you find yourself in a situation that your current insurance company has dropped your home policy? Many people find themselves in this predicament, and it's important to understand your rights as a policyholder.

A dropped homeowners' insurance policy, also called cancellation or nonrenewal coverage, can create a stressful situation. But it's not as bad as you think. Here are four easy steps that will help you to get your life back on track.

What are your rights as a policyholder?

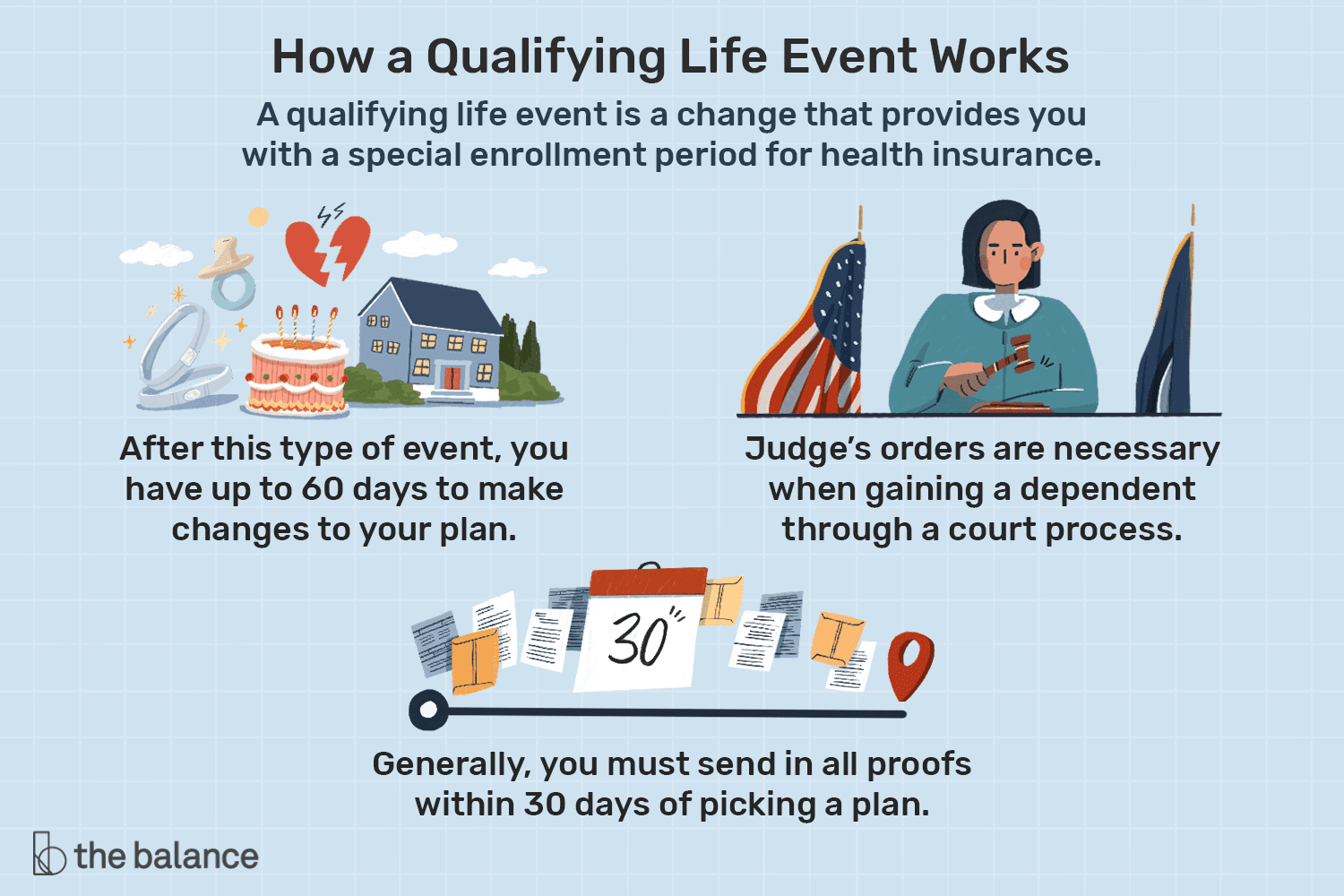

You are entitled to a 30-day written notice before your policy will be cancelled or not renewed. You will have enough time to shop around for another insurer, thus avoiding paying for gaps in coverage.

You can complain to the insurance regulator in your state if you don't receive a written notification from the insurance company. Your complaint will be reviewed and they will decide whether to take any further action.

Your insurance cancellation rights

Insurers can cancel a homeowners policy 60 days after the date of purchase if they fail to pay premiums. Insurance companies can cancel a homeowner's policy if the insured fails to pay premiums or commits fraud.

A change in the condition or value of the property is another reason to drop a policy. Insurance costs will be higher for a home damaged in a fire than a vacation rental that is unoccupied.

It's also a good idea to check your credit score before getting a homeowners policy. If you have a low credit score, it can be difficult to get a loan and insurance companies might view you as more of a risk.

Your home insurance can be cancelled if there are too many gaps in your coverage. A lapse is when you stop paying your insurance premiums. Most companies have grace periods that allow policyholders to catch up and reinstate their coverage.

A change in the level of risk for your home or multiple claims are also reasons why you may lose home insurance. A change in your home's risk level can occur if there have been a lot of claims on your home or if the home has become dangerously neglected.

Your rights if you are a policyholder

It can be difficult to get insurance after a policy has been dropped, especially if you have a bad credit score or other issues. It is best to speak with a financial adviser who can guide you in finding coverage that suits your budget and needs.

Online brokers can assist you in comparing rates and options if you don't already have one. They typically specialize in multiple home insurance companies and will be able to give you a better sense of which ones are a good fit for your risk profile.